Why are people with middle-class incomes more anxious about their economic situation than a generation ago? The usual answers are either “income stagnation” or “you’re imagining this, there’s actually not a problem.”

I suggest it is something else: an ever-rising percentage of middle-class expenses fall outside an individual’s control, giving the individual less economic autonomy and resilience.

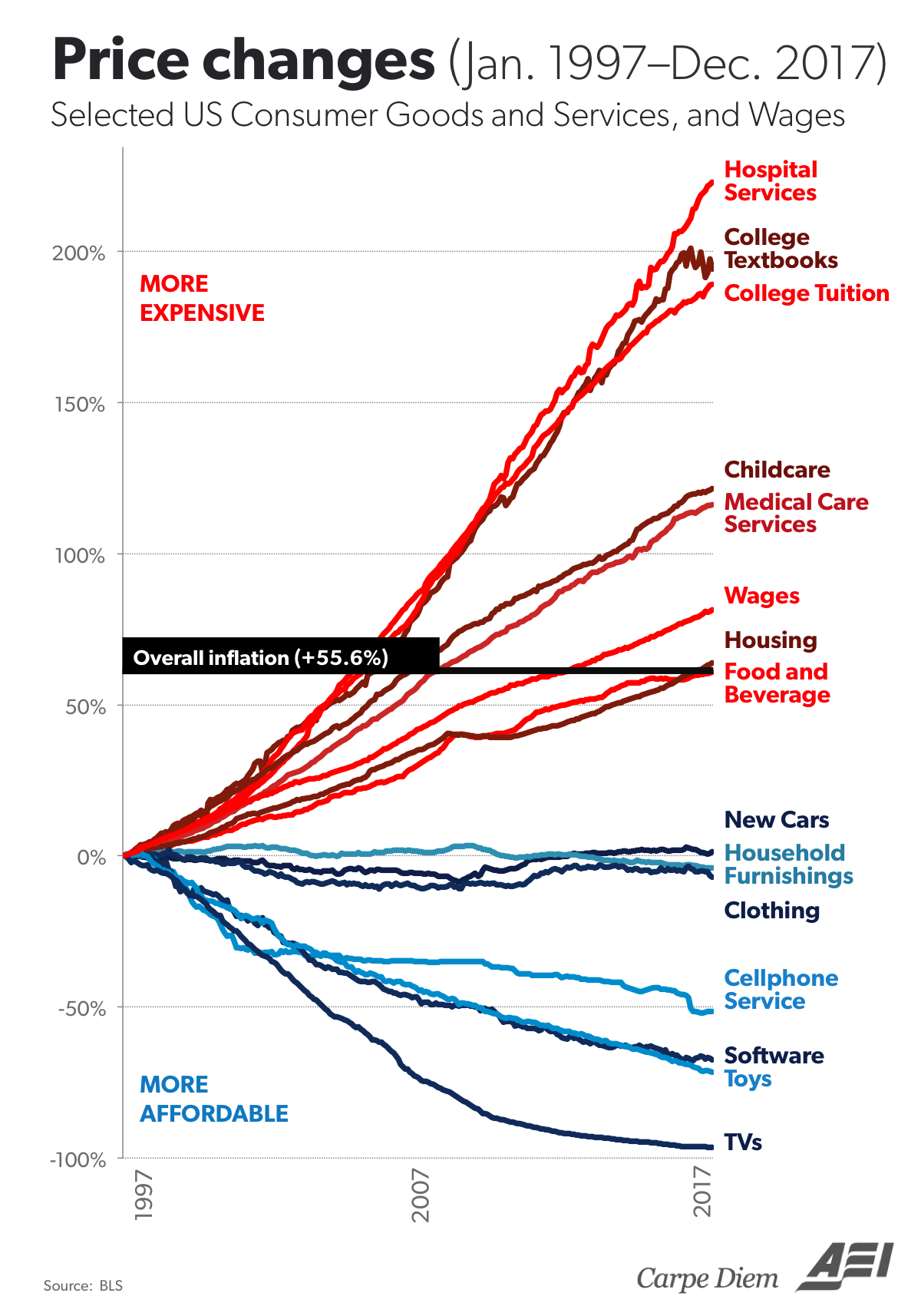

You’ve probably seen this:

This graph is a political Rorschach test. Depending on your pre-existing political beliefs, you will tend to think the high-inflation items above (which I’ll abbreviate as “HI”) outpaced the low-inflation ones (“LO”) because of one of these three things:

- HI are unfettered monopolies, while LO are not.

- HI are produced domestically, while LO are offshored.

- HI are government-subsidized, while LO are not.

Girls, don’t fight: you’re all pretty. Rather than argue over causes, think about the likely effect.

With few exceptions, the LO items can all be delayed for months or years in a pinch, but the HI items are urgent necessities. You can skip this year’s new TV, or buy one used off eBay. You can’t delay or negotiate food, rent or a hospital visit.

Compounded over decades, it is easy to see that an ever-rising share of middle-class income consists of costs that fall outside your span of control. This leads to a sense that you don’t control your destiny.

Which of the following two options feels more secure: a $50k after-tax income with $25k in non-negotiable fixed costs? Or a $100k income with $99k in fixed costs? You’d sleep better at night taking option A. It offers less income, but more security, because more of your cost structure is under your own control.

Many or most people with incomes below the 90th percentile have been forced, by the changing expense mix shown in the graph above, into option B: superficially prosperous, but head barely above water, exposed to the slightest economic dislocation. That’s stressful and frustrating.

Wonder why people under 30 don’t own cars? Why socialism is suddenly popular? Why no one has more than a few weeks’ savings? Why so many are so pessimistic about their future? This! This is why.

—